boulder co sales tax rate 2020

Total Boulder County tax rate. City of Longmont Sales Tax Rates.

Colorado Sales Tax Rates By City County 2022

How to Apply for a Sales and Use Tax License.

. The sales tax jurisdiction name is Santa Cruz County Tourism Marketing District which may refer to. The December 2020 total local. Tax description Assessed value Millage rate Tax amount.

The minimum combined 2022 sales tax rate for Boulder County Colorado is. This home was built in 1979 and last sold on for. Fast Easy Tax Solutions.

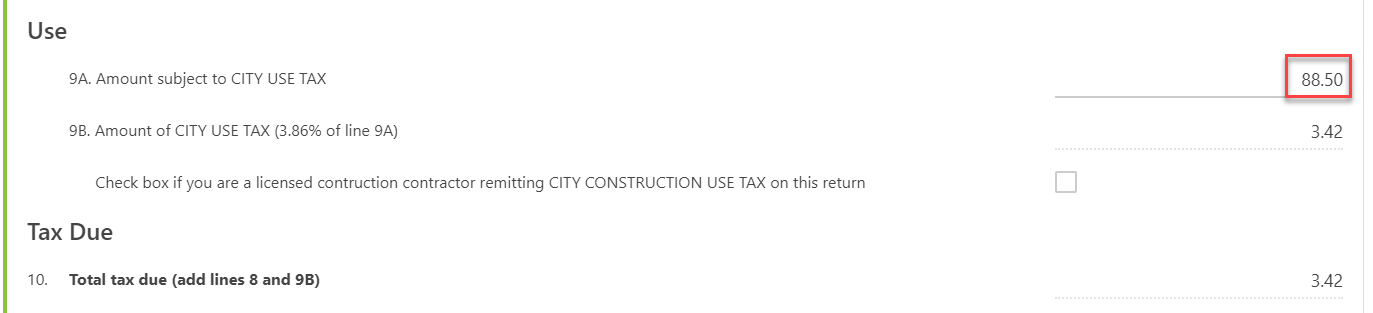

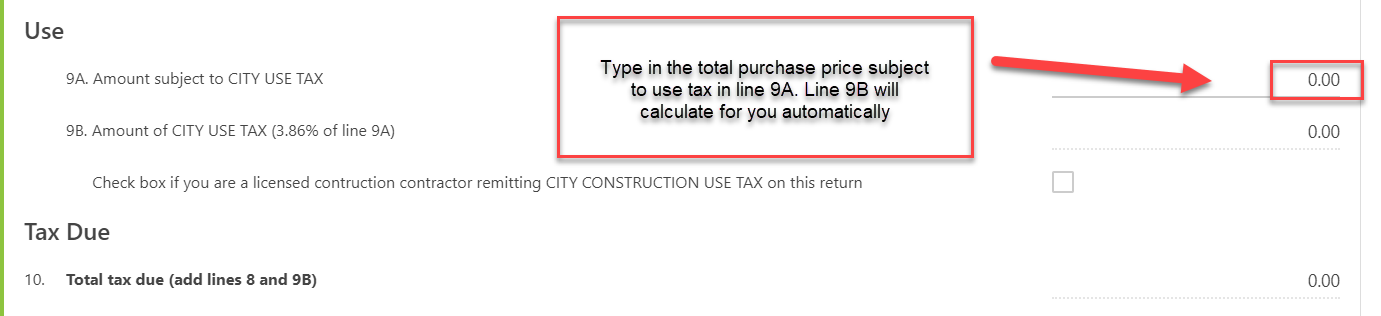

The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Para asistencia en español favor de mandarnos un email a. What is the sales tax rate in Boulder Colorado.

There is no applicable city tax. 265 Bellevue Dr Boulder CO 80302-7817 is currently not for sale. Salestaxbouldercoloradogov o llamarnos a 303-441-4425.

The December 2020 total local sales tax rate was also 9000. You can print a 8845 sales tax table here. The December 2020 total local sales tax rate was 8635.

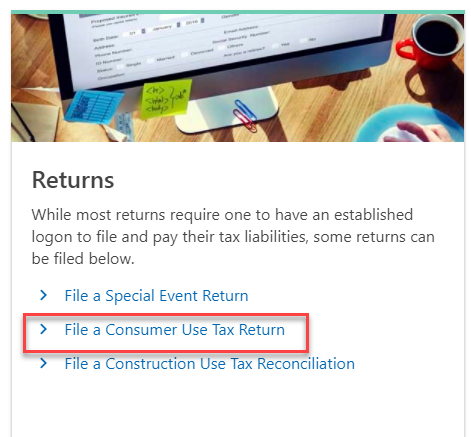

Two services are available in Revenue Online. Ad Find Out Sales Tax Rates For Free. The 2020 Boulder County sales and use tax rate is 0985.

Find both under Additional Services View Sales Rates and Taxes. 20192020 Comparable Sales 20192020 Non-Residential Sales Comparable Residential Sales Mapping Tool Base Period Sales from July 1 2016June 30 2018. Wayfair Inc affect Colorado.

Did South Dakota v. The Colorado sales tax rate is currently. Prior Year Sale Information.

Boulder co sales tax rate 2020 Sunday March 20 2022 Edit. 2265 lower than the maximum sales tax in CO. The 9 sales tax rate in Boulder Creek consists of 6 California state sales tax 025 Santa Cruz County sales tax and 275 Special tax.

The minimum combined 2022 sales tax rate for Boulder Colorado is. Higher sales tax than 85 of Colorado localities. 2055 lower than the maximum sales tax in CO.

View Local Sales Tax Rates. The Colorado state sales tax rate is currently. The current total local sales tax rate in Boulder County CO is 4985.

The Boulder County Niwot Lid Colorado sales tax is 599 consisting of 290 Colorado state sales tax and 309 Boulder County Niwot Lid local sales taxesThe local sales tax consists of a 099 county sales tax and a 210 special district sales tax used to fund transportation districts local attractions etc. Boulder County Niwot Lid. The 2018 United States Supreme Court decision in South Dakota v.

Licensed retailers can find rate and jurisdiction code information for. If a vehicle is purchased from a private party all sales taxes are collected by Boulder County Motor Vehicle. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offe nder management nonprofit capital.

The County sales tax rate is. This is the total of state and county sales tax rates. The current total local sales tax rate in Boulder CO is 4985.

For tax rates in other cities see Colorado sales taxes by city and county. The Boulder County sales tax rate is. Has impacted many state nexus laws and sales.

The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. The current total local sales tax rate in Boulder Creek CA is 9000. State county city and regional transportation district sales use taxes are based on the following.

View Business Location Rates. The Boulder sales tax rate is. This service provides tax rates for all Colorado cities and counties.

City of Longmont 353 State of Colorado 290 RTD 100 Cultural District 010 Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. This is the total of state county and city sales tax rates. Boulder CO 80306-0471 New as of Jan 4 2021 Monday thru Thursday Hours.

Prior 20192020 Tax Years. For tax rates in other cities see Colorado. The ESD tax is on top of the City of Boulder sales tax rate of 386.

About City of Boulders Sales and Use Tax. Any unpaid sales taxes are collected by Boulder County Motor Vehicle. The 8635 sales tax rate in Louisville consists of 29 Colorado state sales tax 0985 Boulder County sales tax 365 Louisville tax and 11 Special tax.

Boulder County CO Sales Tax Rate. The Boulder Sales Tax is collected by the merchant on all qualifying sales. Notice that we use 2020 millage rates since 2021 rates are not available yet.

The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. 730 am5 pm CLOSED Friday. You can print a 8635 sales tax table here.

As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components. Boulder CO Sales Tax Rate. Sales Tax Rates in Revenue Online.

The December 2020 total local sales tax rate was 8845.

What Is Colorado S Sales Tax Discover The Colorado Sales Tax Per County

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

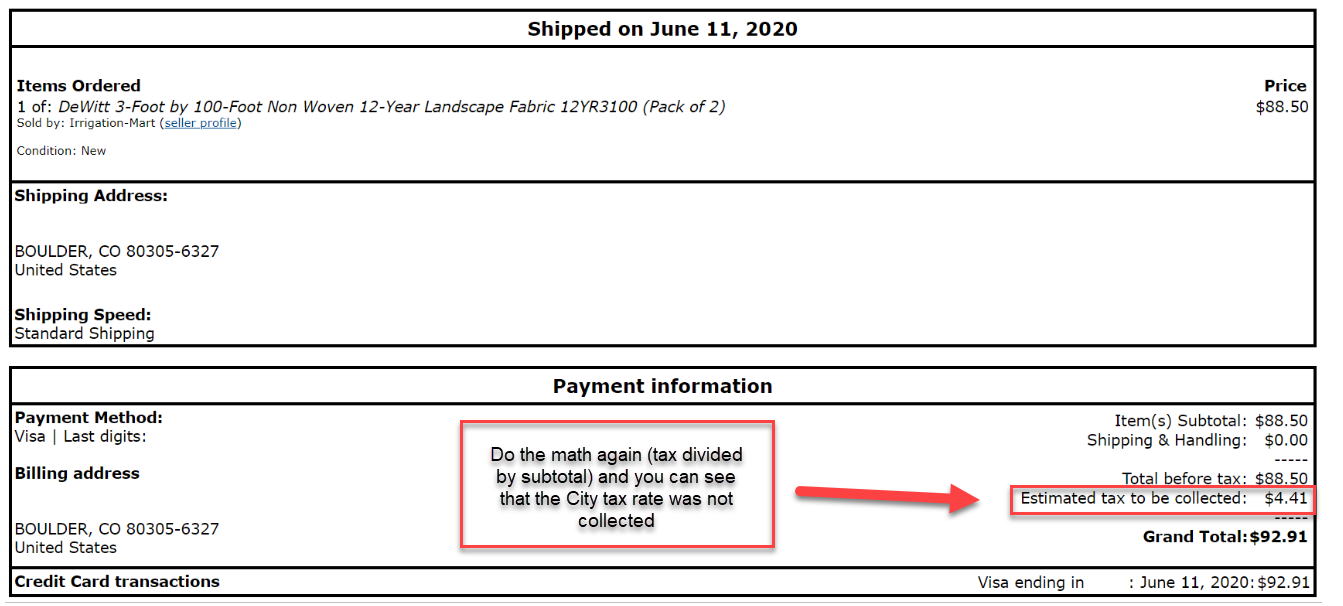

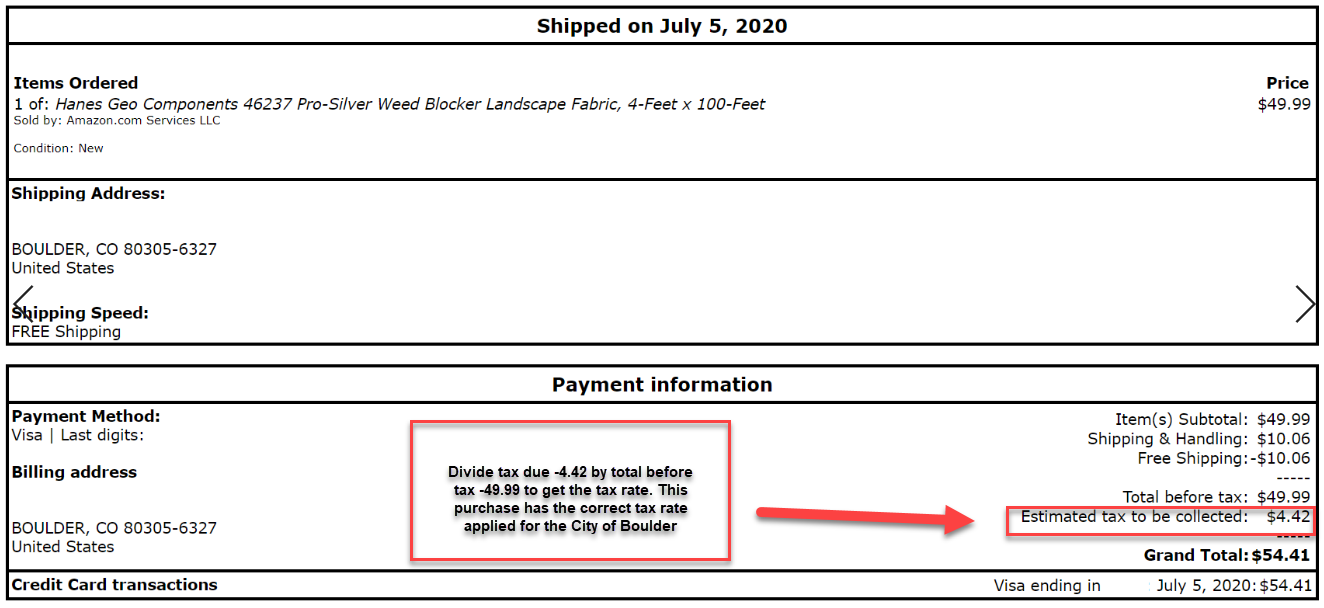

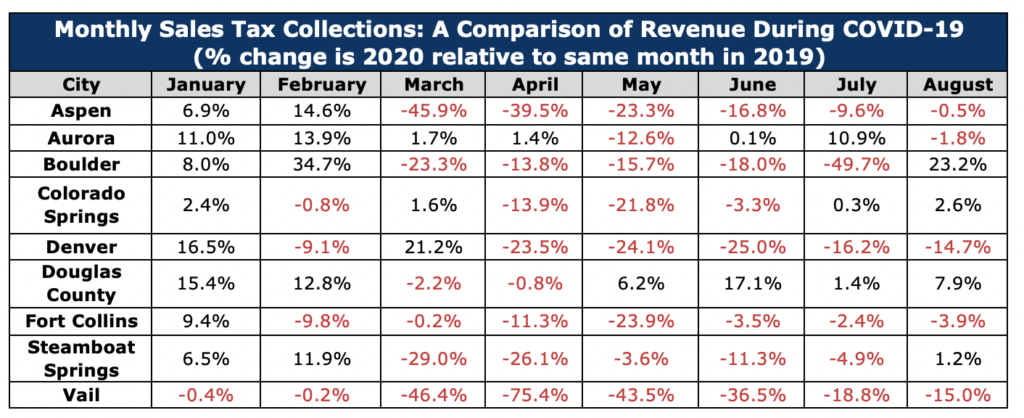

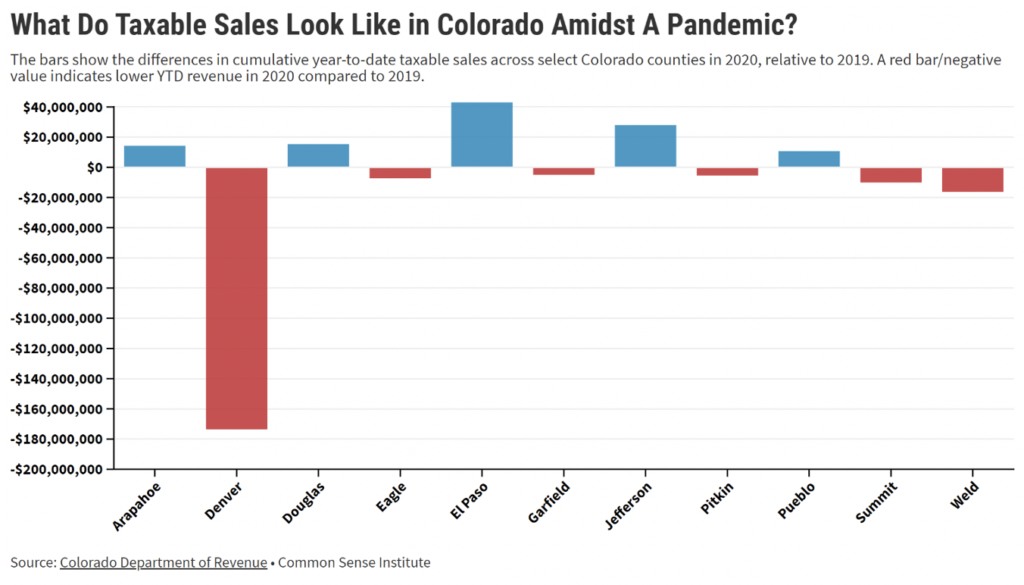

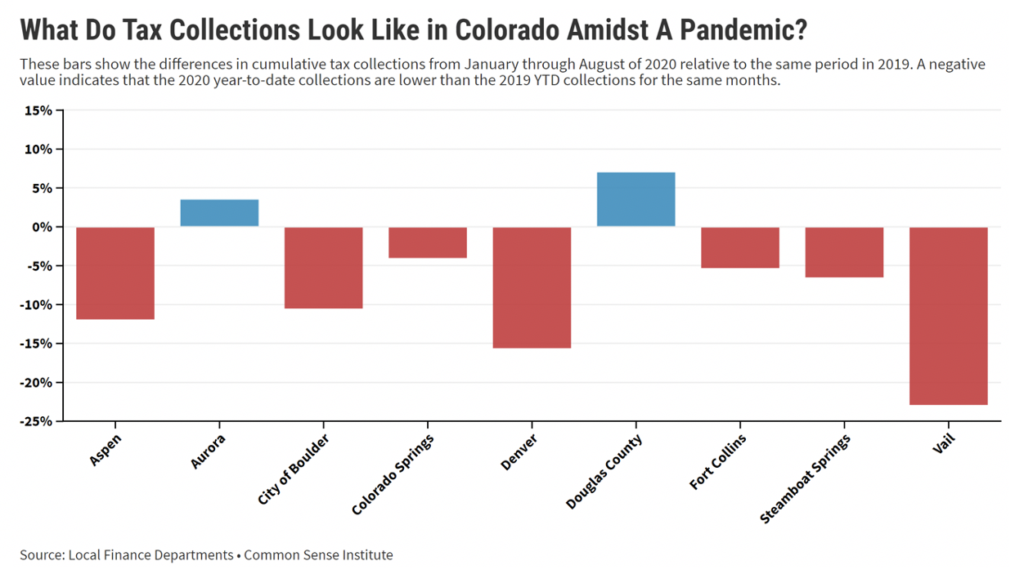

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales And Use Tax City Of Boulder

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

File Sales Tax Online Department Of Revenue Taxation

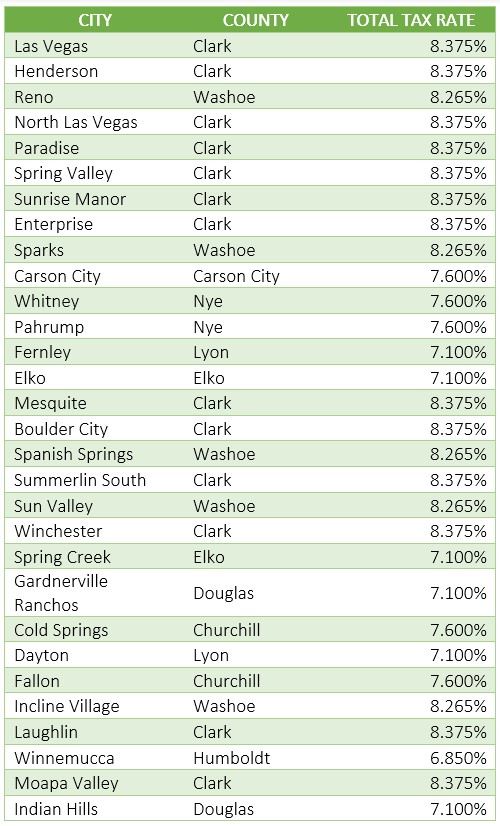

Nevada Sales Tax Guide For Businesses

What Is Colorado S Sales Tax Discover The Colorado Sales Tax Per County